NYT: Fed Chair Powell Faces DOJ Investigation Over Building Renovations

Key USDA reports Monday | SCOTUS | FY 2026 spending | Iran | Cuba | Venezuela | Russia sanctions | Farm Bureau convention | International aid programs

| LINKS |

Link: Video: Wiesemeyer’s Perspectives, Jan. 11

Link: Audio: Wiesemeyer’s Perspectives, Jan. 11

| The Week Ahead: Jan. 11, 2026 |

| UP FRONT |

TOP STORIES

— NYT: Prosecutors open criminal inquiry into Fed Chair Powell over HQ renovation. Federal investigators are reviewing whether Jerome Powell misled Congress about the scope/cost of the Fed’s renovation, escalating President Trump’s clash with the central bank.

— AFBF: Duvall urges farmers to “imagine, grow, lead” as farm economy strains. Farm Bureau President Zippy Duvall mixed culture/faith with policy advocacy — pushing leadership, mental-health resources, trade over tariffs, and more relief for specialty crops.

— Trump weighs military options as Iran protests turn deadly. Trump is weighing responses that could include limited strikes targeting Iranian security services, while aides warn intervention could backfire and spur retaliation.

— Trump pressures Cuba after Maduro capture, warns oil supplies will be cut. Trump says Cuba must “make a deal” and claims Venezuelan oil will stop flowing to Havana, intensifying regional pressure after the Maduro operation.

— Supreme Court poised (again) to decide fate of Trump tariffs. A decision could come as soon as Jan. 14 on whether emergency authorities were stretched too far — raising stakes for trade policy, refunds, and congressional power over tariffs.

— U.S. could lift more Venezuela sanctions as soon as next week: Bessent. Treasury’s Scott Bessent says additional easing could come quickly to enable Venezuelan oil sales and re-engagement with IMF/World Bank leadership.

— Trump signs order shielding Venezuelan oil revenues in U.S. from court seizure. An executive order blocks courts/creditors from attaching Venezuelan oil funds held in U.S. accounts, framed as a national-security and foreign-policy move.

— Prevent plant buy-up coverage faces elimination as comment deadline nears. Farm groups are urging producers to file comments by Jan. 27 opposing elimination of the +5% prevented-planting buy-up, warning it weakens the safety net.

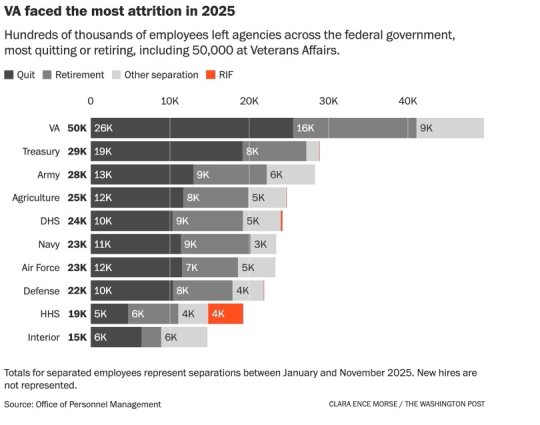

— USDA among hardest hit as Trump workforce cuts reshape federal agencies. New OPM data show steep USDA attrition — especially among food inspectors — raising questions about inspection capacity and program delivery.

— Minnesota farmers want Sen. Amy Klobuchar (D-Minn.) to stay in the Senate. Producers say they want Klobuchar to remain in Washington rather than run for governor, citing her bipartisan effectiveness and national leverage.

— USDA halts $129 million in benefit funding to Minnesota amid fraud allegations. USDA Secretary Brooke Rollins suspended federal benefit awards to Minnesota/Minneapolis pending proof systemic fraud has been stopped, intensifying state political tensions.

— NYT: Trump’s first-term judges are powering his second-term legal wins. A Times tally finds Trump-appointed appellate judges overwhelmingly reversing lower-court rulings against his agenda, strengthening his legal footing.

— Congress: In focus — trade authority, Russia sanctions, farm/budget fights. Lawmakers return with tariffs and presidential trade power, Russia sanctions, agriculture aid/SNAP oversight, and workforce/appropriations pressures converging at once.

— Senate opens week with procedural vote as shutdown clock ticks. The Senate starts with a motion to proceed on a package of three FY26 spending bills, with six more measures needed by Jan. 30 to avert a funding lapse.

— International aid largely spared as bipartisan funding bill rejects Trump cuts. A State/National Security spending package boosts several accounts above White House requests while paired with Financial Services; Homeland Security remains unresolved.

— Tariffs and presidential trade authority dominate the agenda. With the Supreme Court decision nearing, lawmakers are prepping potential IEEPA guardrails, tariff-revenue refund questions, and broader trade-authority changes.

— House GOP pushes to codify Trump baseline tariffs (Fair Trade Act of 2026). A new bill would formalize 10%/15% tariff baselines tied to trade balances and require committee consultation—aimed at making the tariff structure durable.

— Russia sanctions: 500% tariff proposal on countries buying Russian oil. A bipartisan idea would hit imports from major Russian-oil buyers (including China/India/Brazil), with risks of retaliation and broader trade conflict a central concern.

— 500% tariff bill + China retaliation risk — soybeans in the crosshairs. Lawmakers and analysts see agriculture — especially soybeans — as a likely target if Beijing responds to secondary-tariff escalation.

— Agriculture policy: farm aid, SNAP, USDA oversight. Farm-state pressure is building around additional aid tied to trade disruption, SNAP integrity/waivers, and heightened scrutiny of USDA program management.

— Budget pressures and agency staffing concerns. Attrition across agencies (including USDA) is becoming part of the appropriations debate, with members expected to press on service backlogs and enforcement capacity.

— Capitol Hill braces for fallout after ICE officer kills Minnesota woman. The shooting is driving demands for investigations and potential funding constraints on ICE, with DHS politics colliding with shutdown negotiations.

— Outlook for the week ahead. Trade authority, sanctions, farm support, and ICE oversight are set to collide across Congress, courts, and the White House in a compressed January window.

— KEY EVENTS (week of Jan. 12). A packed schedule of Fed speakers, AFBF convention events, major hearings, and foreign-policy forums sets the week’s policy and market backdrop.

— ECONOMIC REPORTS (week of Jan. 12). Big-bank earnings, CPI/PPI, retail sales, Beige Book, and multiple Fed appearances headline the macro calendar.

— AG REPORTS (week of Jan. 12). Monday features USDA’s major report slate (WASDE, Grain Stocks, Crop Production, etc.), followed by dairy/meat and outlook tables through the week.

— ENERGY REPORTS (week of Jan. 12). Multiple OMB biofuel/45Z meetings plus EIA data, OPEC report, and global energy conferences drive the energy-policy and market calendar.

| TOP STORIES—NYT: Federal prosecutors open criminal inquiry into Fed Chair Powell over headquarters renovationNew York Times reports the investigation centers on whether Jerome Powell misled Congress about a costly Fed renovation, escalating President Trump’s long-running clash with the central bank Federal prosecutors in Washington have opened a criminal investigation into Jerome H. Powell, the chair of the Federal Reserve, focusing on whether he misled Congress about the scope and cost of a massive renovation of the Fed’s headquarters, according to the New York Times. The inquiry, approved in November by Jeanine Pirro after she was appointed to run the U.S. attorney’s office for the District of Columbia, includes a review of Powell’s public statements and an examination of spending records tied to the roughly $2.5 billion project. The investigation marks a significant escalation in the confrontation between Donald Trump and the Fed chair, whom the president has repeatedly criticized for resisting aggressive interest-rate cuts, the Times reported. Trump has publicly threatened to fire Powell and floated the possibility of legal action related to the renovation, citing what he has called “incompetence.” In a recent interview with the New York Times, Trump said he has already chosen a successor for Powell and is expected to announce that decision soon. Kevin A. Hassett, Trump’s top economic adviser, is widely viewed as a leading contender. Powell’s term as Fed chair expires in May, though his term as a governor runs through January 2028. He has not said whether he plans to remain at the central bank beyond this year. The Fed declined immediate comment, and the Justice Department did not respond to requests for comment, according to the Times. The probe also underscores a broader Trump administration effort to challenge the Federal Reserve’s independence. The president has separately sought to remove Lisa D. Cook, another Fed governor, over allegations of mortgage fraud — an effort now headed to the Supreme Court for arguments later this month. At the center of the Powell inquiry is a renovation project that began in 2022 and is scheduled for completion in 2027. Costs are now estimated to be about $700 million over budget. The work involves modernizing the historic Marriner S. Eccles Building and a second Fed building on Constitution Avenue, including asbestos and lead removal and upgrades to meet accessibility standards. A 2021 proposal described features such as private dining areas, upgraded marble, and a rooftop terrace, which critics later seized upon. At a congressional hearing last June, Powell denied that many of those elements were part of the current plan, saying some features were removed as designs evolved. Afterward, the Fed published detailed explanations, photos, and a virtual tour to defend the project and explain the overruns, citing higher material and labor costs and unforeseen contamination issues. As the New York Times notes, opening an investigation does not guarantee charges. Previous high-profile probes targeting Trump critics have failed to produce indictments, underscoring the uncertainty over whether prosecutors will ultimately present a case to a grand jury.—AFBF President Duvall urges farmers to “imagine, grow, lead” as farm economy strains deepenSpeaking in Anaheim, American Farm Bureau President Zippy Duvall blended humor, faith, and policy advocacy — calling for stronger leadership, expanded relief for specialty crops, and sustained pressure on Washington as agriculture faces historic losses Addressing members at the annual convention of the American Farm Bureau Federation, President Zippy Duvall opened on a personal note, thanking farm families for their resilience and underscoring the sense of community that defines Farm Bureau. “Truly, I am so grateful to be here with you all,” he said. “We love the Farm Bureau family.” Duvall quickly turned to the economic reality facing agriculture. “We have faced some tough times across agriculture this year, and there’s no sugarcoating that,” he told the crowd. “It’s real, and I know it has been difficult for many of you.” Still, he stressed that optimism remains foundational to farming. “Every farmer has a seed of optimism that we plant as we look to the future,” he said. “Optimism is part of our DNA.” That outlook framed the convention theme — Imagine. Grow. Lead. “Imagination helps us envision what is possible for our families, our farms and our communities,” Duvall said, pointing to advances in precision agriculture, crop protection, and livestock health. “If we’re going to be ready for the challenges of tomorrow, we need the brightest minds and the hardest workers finding solutions today.” Leadership development was a central pillar of the address, with Duvall challenging young farmers to step forward now. “Wherever you are on your leadership journey, I want you to know that your Farm Bureau family is here for you and cheering you on,” he said. “I challenge you to unleash your imagination HERE. TODAY.” He emphasized that leadership is not age-limited, adding, “When we stop imagining, we stop growing.” Duvall also addressed the emotional toll of the downturn, highlighting Farm Bureau’s Farm State of Mind initiative. “We are now leading an alliance across agriculture to ensure every farmer can get the help he or she needs,” he said. “And this work is saving lives.” He reminded members, “It’s okay not to be okay, but it’s not okay to not talk about it.” On policy, Duvall described Farm Bureau’s expanding footprint in Washington, including unprecedented engagement with the White House and cabinet officials and a direct meeting with Donald Trump. “I was very frank with President Trump about the challenges we are facing,” Duvall said. “I made it clear that Farm Bureau policy supports trade, not tariffs.” He added, “Farmers are ready to reach more markets with American-grown products.” Duvall outlined recent advocacy wins, including renewal of key tax provisions, estate tax protections for farm families, labor relief through changes to H-2A wage rates, a revised WOTUS rule, and nearly $70 billion in farm-program investments through the One Big Beautiful Bill Act. “Those are hard-fought victories,” he said. “Those are YOUR victories too.” But he was equally clear that current relief falls short — particularly for specialty crop producers. “We also know that one billion for specialty crops isn’t enough,” Duvall said, drawing applause. While welcoming the administration’s $12 billion bridge program, he cautioned, “The losses are much deeper than that. More support is still needed to cover the tens of billions lost over the last couple years.” He pledged that Farm Bureau will continue pressing Congress for additional aid, stressing that specialty crops must not be left behind as policymakers debate next steps. Duvall also pointed to emerging policy debates around food, health, and sustainability, including engagement with the Make America Healthy Again (MAHA) movement. “We all want to see healthier outcomes for our families and communities,” he said, “but we need leaders to make decisions that are grounded in science.” He emphasized that farmers must remain central to those conversations, noting Farm Bureau’s efforts to bring producers directly to policymakers and consumers. Closing the address, Duvall urged members not to wait to be asked to lead. “Leaders don’t just sit back, waiting to be called on,” he said. “We need leaders who raise their hands and say, ‘I’m here. Put me in, Coach.’” He ended with a call for unity and resolve: “Can you imagine what we can achieve together? Can you imagine a better time to start than today?”—Trump weighs military options as Iran protests turn deadlyPresident signals willingness to strike Iranian security forces if violence against civilians escalates, while aides warn intervention could backfire President Donald Trump is actively weighing a range of potential U.S. responses — including limited military strikes — as anti-government protests in Iran intensify and the reported death toll climbs to 540 or above. No final decision has been made, officials said. Trump has been briefed in recent days on multiple options, some involving direct military action and others stopping short of U.S. force. Several proposals focus on targeting Tehran’s security services accused of suppressing protests, though officials emphasized that no final decision has been made. Any action under consideration would exclude U.S. “boots on the ground,” a senior White House official said. Trump said that the US is closely monitoring the protests in Iran and is mulling potential options as the Islamic Republic faces its third week of nationwide protests, the largest since 2022. “We’re looking at it very seriously. The military is looking at it, and we’re looking at some very strong options,” Trump told reporters Sunday as he returned to Washington from his Mar-a-Lago home. “We’ll make a determination.” Administration officials have also raised internal concerns that strikes could undermine the protest movement by rallying public support behind Iran’s government or triggering Iranian retaliation. Those risks are weighing alongside Trump’s increasingly forceful public rhetoric. Trump has publicly warned Tehran against the use of lethal force. “If they start killing people like they have in the past, we will get involved,” he told reporters Friday, adding that intervention would mean “hitting them very, very hard where it hurts,” rather than deploying ground troops. In a weekend social media post, Trump wrote that Iran is “looking at FREEDOM, perhaps like never before,” and said the U.S. stands “ready to help.” Iran’s parliament speaker warned Sunday that the U.S. military and Israel would be “legitimate targets” if the U.S. strikes the Islamic Republic over the ongoing protests roiling the country, as threatened by Trump. Iran has blamed Trump for fueling the protests and accused the U.S. and Israel of importing “rioters.” Iran warned it could hit American bases in the Middle East if the U.S. hits first. The situation is also drawing close attention from U.S. allies. Secretary of State Marco Rubio spoke Saturday with Israeli Prime Minister Benjamin Netanyahu, discussing the protests alongside broader regional tensions in Syria and Gaza, according to sources familiar with the call. Israel’s military said it is monitoring developments closely. The Israel Defense Forces described the unrest as an internal Iranian matter but said it is maintaining defensive readiness as protests enter a third week. Netanyahu is expected to convene a limited security consultation with Iran and Lebanon high on the agenda, underscoring the growing regional stakes as Washington weighs its next move. —Trump pressures Cuba after Maduro capture, warns oil supplies will be cutPresident says Havana must “make a deal” as Washington tightens the screws following Venezuela operation President Donald Trump escalated pressure on Cuba over the weekend, declaring that the island nation would receive “ZERO” oil from Venezuela after the U.S. capture of Venezuelan leader Nicolás Maduro. In a series of Truth Social posts, Trump argued that Cuba has long depended on Venezuelan oil and money, and said that support would end following U.S. intervention. Trump also claimed Venezuela no longer needed Cuban security assistance and was now under the protection of the U.S. military, adding that 32 Cuban military personnel were killed during the operation that led to Maduro’s capture. The president used the moment to amplify criticism of Havana, reposting memes and commentary — including jokes about Secretary of State Marco Rubio, the son of Cuban immigrants, becoming Cuba’s president. Cuba’s leadership pushed back sharply. President Miguel Díaz-Canel blamed the United States for the country’s economic crisis, citing decades of U.S. sanctions and warning that Washington was threatening to intensify what he called “draconian” pressure. While Trump has said Cuba “looks like it is ready to fall,” U.S. intelligence assessments cited by Reuters do not predict an imminent collapse, even as the country faces severe energy shortages and rolling blackouts. The confrontation comes amid broader regional fallout from Maduro’s capture. The Trump administration has continued seizing sanctioned Venezuelan oil shipments — some reportedly bound for Cuba — and is using the episode to pressure other Latin American leaders. Tensions with Colombia briefly flared after Trump criticized President Gustavo Petro, though both sides have since agreed to a White House meeting in February.—Supreme Court poised (again) to decide fate of Trump tariffsJustices could rule as soon as Jan. 14 on whether the president overstepped emergency powers, with billions in trade levies at stakeThe future of most tariffs imposed by Donald Trump now rests with the U.S. Supreme Court, which is expected to issue a ruling as early as this month on the legality of the sweeping import taxes. Some reports expected new on Jan. 9, but no such announcement occurredLower federal courts ruled in 2025 that the tariffs were imposed unlawfully, concluding that the administration exceeded its authority under a 1977 statute that grants presidents special powers during national emergencies. Despite those rulings, the tariffs were allowed to remain in force while the Trump administration appealed, keeping billions of dollars in duties flowing to the federal government and preserving the trade policy status quo for importers and exporters. During oral arguments on Nov. 5, several justices appeared skeptical that the law in question gave the president such broad unilateral authority to impose tariffs without explicit congressional approval. The questioning suggested concern that upholding the tariffs could significantly expand executive power over trade, potentially sidelining Congress’ constitutional role in setting taxes and regulating commerce. The delay keeps markets and trade partners waiting as the justices consider challenges to tariffs imposed under emergency authorities. Prediction markets like Polymarket indicate a roughly 75% probability that the Supreme Court will rule against the administration and eliminate or limit the tariffs. Regardless, the policy uncertainty did not seem to impact the market much on Friday. Speaking to CNBC, National Economic Council Director Kevin Hassett said the White House remains confident it will prevail — but emphasized contingency plans are ready if the court rules otherwise. Hassett said the administration could pivot to “other legal authorities” to achieve the same outcomes in trade deals “basically immediately.” Those preparations include work by U.S. Trade Representative Jamieson Greer, whom Hassett said helped lead late-night discussions on next steps should the court strike down the tariffs imposed under the International Emergency Economic Powers Act (IEEPA). Earlier in the week, Trump highlighted the stakes, claiming the U.S. has taken in — and will soon receive —more than $600 billion in tariff revenue, calling the pending decision one of the most consequential in the court’s history.While the court does not announce decisions in advance, the justices have scheduled Wednesday, Jan. 14, as their next formal “opinion day,” making it a plausible date for a ruling. A decision striking down the tariffs could trigger refund claims for importers and force a rapid reassessment of U.S. trade policy, while a ruling in favor of the administration would reinforce expansive presidential authority during declared emergencies and shape how future presidents deploy tariffs as a policy tool. —U.S. could lift more Venezuela sanctions as soon as next week: Bessent Treasury Secretary Scott Bessent told Reuters that Washington may ease additional sanctions to facilitate oil salesand plans meetings with IMF and World Bank leaders on Venezuela’s economic re-engagement. The U.S. could lift additional sanctions on Venezuela as early as next week to help enable oil sales and support the country’s economic recovery, U.S. Treasury Secretary Scott Bessent indicated in a Reuters interview.Bessent, speaking late Friday, said the Treasury is reviewing changes that would ease restrictions on Venezuelan oil sales and facilitate the repatriation of proceeds back into the Venezuelan economy. While he did not specify which sanctions might be removed, he commented “It could be as soon as next week.”He also plans to meet next week with the heads of the International Monetary Fund and the World Bank to discuss re-engaging both institutions with Venezuela, which has had limited formal ties with them for more than two decades.The discussions are part of broader U.S. efforts to stabilize Venezuela and encourage the return of U.S. energy producers to its oil sector following recent political developments in the country.—Trump signs order shielding Venezuelan oil revenues in U.S. from court seizureMove framed as vital to U.S. national security and foreign policy amid broader Venezuela strategy President Donald Trump signed an executive order declaring a national emergency to protect oil revenues from Venezuela that are held in U.S. Treasury accounts, blocking U.S. courts or creditors from seizing the funds. The White House said such seizures would undermine key U.S. national security and foreign policy objectives, particularly efforts to promote stability in Venezuela and counter illicit narcotics and migration pressures. The order defines these revenues as sovereign Venezuelan assets held for governmental and diplomatic purposes and provides that they cannot be attached or otherwise subject to judicial process without authorization. Administration officials argue that safeguarding the funds will strengthen U.S. leverage in the region and support broader strategic goals. This action comes as the U.S. also engages with major oil executives to encourage investment in Venezuela’s oil sector and follows recent high-profile developments in the country’s leadership and oil shipments. —Prevent plant buy-up coverage faces elimination as comment deadline nearsFarm groups urged to oppose removal of +5% Prevented Planting coverage before Jan. 27 The public comment period on a regulation that would eliminate the +5% buy-up coverage under Prevented Planting (PP) closes Jan. 27, and farm and ranch stakeholders are being urged to weigh in forcefully. The proposed change — embedded within a broader regulation — has drawn strong objections across the agricultural community. Opponents warn that eliminating the buy-up option would significantly weaken the safety net for producers facing weather-related planting disruptions, increasing financial risk for farm and ranch families nationwide. Producers, agribusinesses, and agricultural organizations are being strongly encouraged to submit comments expressing opposition to the PP changes and clearly outlining the economic and operational harm they would cause. Comments must be filed by Jan. 27 through the Federal eRulemaking Portal (link). While efforts are underway to address the issue legislatively or through administrative action, any administrative fix would not take effect until after June, meaning the regulation would remain in force in the interim if finalized. For now, stakeholder engagement during the comment period remains the most immediate and effective way to influence the outcome. —USDA among hardest hit as Trump workforce cuts reshape federal agenciesMore than a third of USDA food inspectors left in 2025 as voluntary exits, buyouts and retirements — not mass firings — drove the biggest federal workforce contraction since the 1990s USDA emerged as one of the most heavily affected agencies in newly released federal workforce data, underscoring how President Donald Trump’s downsizing campaign reshaped government largely through attrition rather than layoffs, according to a report in the Washington Post (link). According to data published by the Office of Personnel Management, more than one-third of USDA food inspectors left government service in 2025, a striking reduction in a workforce central to meat, poultry and food safety oversight. The losses were driven overwhelmingly by resignations, buyouts and retirements, rather than firings. Attrition, not mass firings. Across the federal government, about 335,000 employees exited between January and November 2025, but only around 11,000 were formally laid off. At USDA, as in most agencies, the bulk of departures were classified as quits or retirements — categories that include workers who accepted buyouts encouraged by the administration and by Elon Musk, who helped spearhead the workforce reduction push. Roughly 154,000 federal workers quit, while more than 100,000 retired, creating processing backlogs and leaving agencies scrambling to fill critical operational gaps. At USDA, inspectors and frontline staff were among those most affected. Policy alignment shapes the cuts. The OPM data — released via a new public workforce dashboard (link) — illustrates how staffing reductions tracked closely with White House policy priorities. While agencies like Immigration and Customs Enforcement and the Secret Service expanded, most civilian agencies shrank.  USDA’s losses stand out because they touch core regulatory functions rather than administrative offices, raising questions about long-term capacity in food inspection, enforcement and program delivery. A changed USDA workforce. Workforce experts say the data reflects an environment that actively encouraged departures. Many federal employees reported burnout and pressure to leave, even in agencies not formally targeted for elimination. Bottom Line: For USDA, the result is a leaner but more strained workforce — one shaped less by direct firings than by a wave of exits that may take years to fully reverse, even if hiring resumes.— Minnesota farmers want Sen. Amy Klobuchar (D-Minn.) to stay in Senate and not run for governor of Minnesota. That is the clear message farmers from Minnesota told us during a recent trip to the state. The gist of the messages: “We need more lawmakers like Amy to work with the other political party to reach a consensus. We need more like her, and not have her leave the Senate where she will have more opportunities to impact the nation rather than as governor of a state currently bogged down with a lot of issues.” —USDA halts $129 million in benefit funding to Minnesota amid fraud allegationsRollins says federal assistance will remain suspended until the state and Minneapolis prove systemic abuse of social programs has been stopped USDA Secretary Brooke Rollins late Friday ordered the immediate suspension of $129 million in federal benefit program funding to Minnesota and the city of Minneapolis, citing what she described as “widespread and systemic fraud” in the administration of social service programs. In a post on X, Rollins said USDA was halting federal financial awards until state and local officials provide “sufficient proof” that the alleged fraud has been brought under control. USDA oversees the Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps. Rollins formalized the decision in a letter sent to Minnesota Gov. Tim Walz and Minneapolis Mayor Jacob Frey, arguing that the scale of the alleged misconduct demonstrates an inability to manage federal resources without tighter oversight and accountability measures. The move comes amid heightened tensions in the Minneapolis/St. Paul region, where protests have intensified following a fatal shooting involving an Immigration and Customs Enforcement agent earlier in the week. Federal agents have also been operating in the area since early December under what ICE has called “Operation Metro Surge.” The funding suspension adds to a volatile political backdrop in Minnesota. Walz, the 2024 Democratic vice-presidential nominee, recently ended his re-election campaign earlier as scrutiny mounted over fraud allegations tied to the state’s welfare system. The action also follows a separate legal development on Friday, when Minnesota joined New York, California and other Democratic-led states in securing a temporary court order blocking the federal government from cutting roughly $10 billion in child-care aid nationwide.—Trump’s first-term judges are powering his second-term legal winsA New York Times analysis shows appellate judges appointed by President Trump overwhelmingly overturn lower-court rulings against his agenda, reshaping the balance of judicial power Appeals court judges selected by Donald Trump during his first term are now reliably reversing district court decisions in his second. In 2025 alone, those judges flipped lower-court rulings 133–12, or 92% of the time, according to a tally by the New York Times. Why it matters: The Times reports that these judges have formed “a nearly united phalanx” defending Trump’s agenda — clearing obstacles to his policies and steadily undercutting the early narrative that courts were blocking his efforts to expand presidential authority. By the numbers:• District courts ruled in favor of Trump’s policies 25% of the time last year.• Appeals courts did so 51% of the time.• The Supreme Court of the United States sided with Trump 88% of the time. Voting patterns by judicial background were stark:• Trump appointees backed Trump 92% of the time.• Other Republican appointees did so 68% of the time.• Democratic appointees supported Trump’s positions 27% of the time. Trump’s long game: Leonard Leo, co-chair of the Federalist Society who helped shape Trump’s first-term judicial selections around “originalism,” told the Times that appellate courts matter far more than many realize. The Supreme Court’s docket is small, he noted, while appellate judges — “superstar” picks in his view — operate with less scrutiny, wield enormous influence, and will remain on the bench for decades. USDA’s losses stand out because they touch core regulatory functions rather than administrative offices, raising questions about long-term capacity in food inspection, enforcement and program delivery. A changed USDA workforce. Workforce experts say the data reflects an environment that actively encouraged departures. Many federal employees reported burnout and pressure to leave, even in agencies not formally targeted for elimination. Bottom Line: For USDA, the result is a leaner but more strained workforce — one shaped less by direct firings than by a wave of exits that may take years to fully reverse, even if hiring resumes.— Minnesota farmers want Sen. Amy Klobuchar (D-Minn.) to stay in Senate and not run for governor of Minnesota. That is the clear message farmers from Minnesota told us during a recent trip to the state. The gist of the messages: “We need more lawmakers like Amy to work with the other political party to reach a consensus. We need more like her, and not have her leave the Senate where she will have more opportunities to impact the nation rather than as governor of a state currently bogged down with a lot of issues.” —USDA halts $129 million in benefit funding to Minnesota amid fraud allegationsRollins says federal assistance will remain suspended until the state and Minneapolis prove systemic abuse of social programs has been stopped USDA Secretary Brooke Rollins late Friday ordered the immediate suspension of $129 million in federal benefit program funding to Minnesota and the city of Minneapolis, citing what she described as “widespread and systemic fraud” in the administration of social service programs. In a post on X, Rollins said USDA was halting federal financial awards until state and local officials provide “sufficient proof” that the alleged fraud has been brought under control. USDA oversees the Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps. Rollins formalized the decision in a letter sent to Minnesota Gov. Tim Walz and Minneapolis Mayor Jacob Frey, arguing that the scale of the alleged misconduct demonstrates an inability to manage federal resources without tighter oversight and accountability measures. The move comes amid heightened tensions in the Minneapolis/St. Paul region, where protests have intensified following a fatal shooting involving an Immigration and Customs Enforcement agent earlier in the week. Federal agents have also been operating in the area since early December under what ICE has called “Operation Metro Surge.” The funding suspension adds to a volatile political backdrop in Minnesota. Walz, the 2024 Democratic vice-presidential nominee, recently ended his re-election campaign earlier as scrutiny mounted over fraud allegations tied to the state’s welfare system. The action also follows a separate legal development on Friday, when Minnesota joined New York, California and other Democratic-led states in securing a temporary court order blocking the federal government from cutting roughly $10 billion in child-care aid nationwide.—Trump’s first-term judges are powering his second-term legal winsA New York Times analysis shows appellate judges appointed by President Trump overwhelmingly overturn lower-court rulings against his agenda, reshaping the balance of judicial power Appeals court judges selected by Donald Trump during his first term are now reliably reversing district court decisions in his second. In 2025 alone, those judges flipped lower-court rulings 133–12, or 92% of the time, according to a tally by the New York Times. Why it matters: The Times reports that these judges have formed “a nearly united phalanx” defending Trump’s agenda — clearing obstacles to his policies and steadily undercutting the early narrative that courts were blocking his efforts to expand presidential authority. By the numbers:• District courts ruled in favor of Trump’s policies 25% of the time last year.• Appeals courts did so 51% of the time.• The Supreme Court of the United States sided with Trump 88% of the time. Voting patterns by judicial background were stark:• Trump appointees backed Trump 92% of the time.• Other Republican appointees did so 68% of the time.• Democratic appointees supported Trump’s positions 27% of the time. Trump’s long game: Leonard Leo, co-chair of the Federalist Society who helped shape Trump’s first-term judicial selections around “originalism,” told the Times that appellate courts matter far more than many realize. The Supreme Court’s docket is small, he noted, while appellate judges — “superstar” picks in his view — operate with less scrutiny, wield enormous influence, and will remain on the bench for decades. |

| —CONGRESS |

—In focus: With the Supreme Court perhaps ruling on Trump-era tariffs, lawmakers want to confront trade authority, Russia sanctions, and unresolved agriculture and budget fights.

Lawmakers are preparing for a compressed but consequential stretch of debate shaped by trade policy, foreign sanctions, and mounting pressure from farm-state lawmakers. Several issues are converging at once, raising the stakes for both leadership and rank-and-file members across parties.

—Senate opens week with procedural vote as shutdown clock ticks

Lawmakers advance three FY 2026 spending bills, but six more measures must clear Congress by Jan. 30 to avoid another funding lapse

The U.S. Senate is set to begin the week with a procedural vote Monday on three fiscal 2026 appropriations bills approved by the U.S. House of Representatives last week, marking an early test of whether Congress can keep funding negotiations on track ahead of a looming shutdown deadline.

The vote is expected to be a motion to proceed, allowing the Senate to formally take up the package and begin debate. While not a vote on final passage, the step is significant: it signals leadership’s intent to move spending bills through regular order rather than rely solely on short-term stopgaps.

If the three measures ultimately clear Congress, lawmakers would still face a heavy lift. Six additional appropriations bills must be enacted by Jan. 30 to keep the government fully funded. Failure to meet that deadline would force Congress to pass a short-term continuing resolution — or risk another partial government shutdown following last year’s record-long lapse in operations.

Senate leaders are bundling the bills to conserve floor time and demonstrate progress early in the year. Even so, differences between House-passed versions and Senate priorities are likely to require amendments or conference negotiations before final approval.

The procedural vote also carries political weight. A smooth advance would reassure federal agencies, contractors, and financial markets that Congress is making headway. A stumble — such as a failed motion or prolonged amendment fights — would compress the calendar and heighten the likelihood of brinkmanship as the January deadline approaches.

Attention now turns to how quickly the Senate can move from procedure to substance, whether bipartisan agreement holds during amendment debates, and whether leaders quietly begin preparing a fallback continuing resolution should negotiations bog down.

—International aid largely spared as bipartisan funding bill rejects Trump cuts

Appropriators boost State Department, global health, and international broadcasting funds above White House requests as Jan. 30 deadline looms

A bipartisan funding package unveiled Sunday would largely shield international aid programs from deep reductions proposed by President Donald Trump, underscoring a break between the White House and congressional appropriators as lawmakers race toward a Jan. 30 funding deadline.

The National Security/State Department bill provides roughly $50 billion for the U.S. Department of State and related programs — $19 billion above the Trump administration’s fiscal 2026 request, though $9.3 billion below current enacted levels. Even so, the total would exceed what the White House spent on international affairs last year by about $5 billion, according to a House Democratic summary released by Rep. Rosa DeLauro.

Key elements of the bill include:

•No direct funding for U.S. Agency for International Development USAID), which the Trump administration shuttered and folded into the State Department. Some former USAID activities would continue through multilateral assistance accounts.

• $6.8 billion for a new National Security Investment Program, consolidating State Department economic assistance programs — $3.9 billion above the White House request.

•More than $9.4 billion for global health, including $5.9 billion for global HIV/AIDS relief and $3.5 billion for maternal and child health, both several billion dollars above the administration’s proposal.

•$643 million for the U.S. Agency for Global Media, which oversees outlets such as Voice of America and Radio Free Asia — nearly $490 million above Trump’s request.

•$3.3 billion in military aid to Israel, consistent with the existing 10-year U.S./Israel security assistance memorandum running through fiscal 2028.

Democrats framed the package as a rejection of what they called “extreme cuts” to humanitarian and global health programs.

Republicans have not yet released their own summaries but are aiming to bring the package to the House floor later this week. The measure is paired with a Financial Services spending bill; efforts to include Homeland Security funding stalled amid contentious negotiations and heightened tensions following a fatal ICE shooting in Minneapolis.

Overall, the bill signals strong bipartisan resistance to sweeping reductions in U.S. international engagement — even as overall spending remains constrained compared with current law.

—Tariffs and presidential trade authority dominate the agenda. The most immediate backdrop is the pending decision by the Supreme Court of the United States on the legality of sweeping tariffs imposed under emergency authorities. With the Court expected to issue opinions as soon as Wednesday, lawmakers are already positioning themselves for possible legislative fallout.

If the Court strikes down the tariffs, Congress could face pressure to:

• Clarify or rein in presidential authority under the International Emergency Economic Powers Act (IEEPA)

• Address potential refunds of tariff revenue

• Consider statutory guardrails for future trade actions

House Ways and Means and Senate Finance members are expected to use the week to preview legislative responses, even if no immediate vote is scheduled.

Meanwhile, a new House bill would hard-code key elements of President Donald Trump’s tariff strategy, imposing 15% tariffs on imports from countries with U.S. trade surpluses and 10% tariffs on goods from deficit countries, on top of existing duties.

The Fair Trade Act of 2026, introduced by Rep. Beth Van Duyne (R-Tex.), would require the president to consult with the House Ways & Means and Senate Finance committees before imposing the tariffs. The bill allows tariffs to be lowered — but not raised — if deemed in the national interest.

Supporters say the measure would formalize the Trump administration’s baseline tariffs announced in 2025 and ensure they persist beyond his presidency. U.S. Trade Representative Jamieson Greer has urged Congress to codify the tariffs to create a durable, bipartisan trade baseline.

The bill follows earlier bipartisan efforts in Congress to lock in Trump-era tariffs, including proposals targeting China and broader calls to codify negotiated trade agreements through 2028 and beyond.

—Russia sanctions and the 500% tariff proposal. Another focal point is a bipartisan proposal to impose punitive tariffs — up to 500% — on countries purchasing Russian oil, including China, India, and Brazil. Supporters argue the bill would tighten economic pressure on Moscow, while critics warn it could ignite a broader trade conflict and provoke retaliation against U.S. exports, particularly agricultural commodities.

Key questions lawmakers are weighing:

• Whether secondary tariffs are an effective sanctions tool

• Risks of retaliation against U.S. soybeans, corn, and energy exports

• The bill’s compatibility with existing trade and WTO frameworks

Leadership discussions could determine whether the measure advances to a floor vote later in January.

| —Trump 500% tariff bill: escalating trade tensions with China — could soybeans be targeted again?Proposed sanctions on countries buying Russian oil risk reigniting a U.S./China trade war, with Beijing likely to retaliate by targeting American agricultural exports — especially soybeans — once againSen. Lindsey Graham (R-S.C.) announced that President Trump has approved a bipartisan Russia sanctions bill that would grant sweeping authority to penalize countries that continue buying Russian oil — including China, India, and Brazil. The proposed legislation, expected to go to a vote soon, would authorize tariffs of up to 500% on imports from these countries to pressure them over energy purchases viewed as supporting Russia’s war effort. How this could impact U.S./China trade relations. This bill represents a major escalation of trade tensions between the United States and China, building on an already fraught tariff landscape:• Under Trump’s second administration, U.S. tariffs on Chinese imports initially soared and China responded with retaliatory tariffs and trade measures on U.S. goods.• China’s earlier responses in previous rounds of tariff increases included tariffs on U.S. agricultural products (soybeans, sorghum, pork, beef, and other staple exports) and revocation of import licenses for U.S. suppliers.These kinds of retaliations have historically had a significant impact on American farmers — especially soybean producers. Would China retaliate against U.S. soybeans again? During earlier U.S./China tariff confrontations:•China imposed tariffs on U.S. soybeans, corn, cotton, and other agricultural products in retaliation for U.S. tariffs on Chinese manufactured goods. This led China to diversify its supply, increasing soybean purchases from Brazil, Argentina, and Uruguay.•The diversion of shipments and reduced U.S. market share caused significant financial stress in U.S. farming regions reliant on exports to China. If the 500% tariff bill passes and is applied:•China would have strong incentive to retaliate economically to protect its trade interests and signal resistance to U.S. pressure.•Targeted agricultural retaliation — especially tariffs on U.S. soybeans and other farm goods — is one of the most likely forms China could take, based on past behavior. •China may further diversify suppliers away from the U.S., deepening relationships with South American producers. Broader strategic implications: 1. Global trade realignments: Prolonged tariff conflict could push China to accelerate trade diversification — boosting ties with South America, Africa, and Southeast Asian producers in agriculture and energy sectors. Such shifts can weaken long-standing U.S. export markets and reduce American influence in global commodity chains. 2. Increased agricultural price volatility: Retaliatory barriers on U.S. crops could tighten global supply chains, leading to price swings in soybeans, corn, and other key commodities. Countries dependent on these imports could see cost pressures that impact food prices domestically, especially in Asia. 3. Strategic diplomatic risks: Economic retaliation by China may not be limited to tariffs — China could limit purchases of U.S. semiconductors, technology inputs, or energy exports, raising broader geopolitical stakes. What to watch next:•Congressional vote timing on the 500% tariff provision. Supporters say it could come as early as the coming week, with bipartisan backing.• Beijing’s immediate response once the bill is formalized — this will signal whether China intends to mirror past retaliations or pursue alternative measures.• U.S. agricultural export data, which could show shifts in destination markets following tariff shocks. |

—Agriculture policy: farm aid, SNAP, and USDA oversight. Farm-state lawmakers are expected to press leadership on unresolved agriculture priorities as producer margins remain under strain. Likely areas of debate include:

•Additional or supplemental farm aid following tariff-related disruptions

• Oversight of USDA program integrity amid recent fraud allegations

• State-level SNAP waivers restricting certain food purchases and retailer compliance timelines

While comprehensive farm legislation is not expected this week, committee-level pressure is building for action early in the year.

—Budget pressures and agency staffing concerns. Lawmakers are returning amid growing concern over federal workforce attrition and agency capacity, including at USDA, Treasury, and Social Security. With appropriators already looking ahead to spring funding deadlines, staffing losses and program delivery risks are increasingly part of the budget conversation.

Members are expected to:

• Question administration officials on workforce reductions

• Assess impacts on inspections, benefits delivery, and enforcement

• Lay groundwork for upcoming appropriations negotiations

—Capitol Hill braces for fallout after ICE officer kills Minnesota woman

Renee Good’s death intensifies scrutiny of Trump’s deportation campaign, fueling calls for investigations, funding restrictions on ICE, and even an unlikely impeachment of Homeland Security Secretary Kristi Noem

The fatal shooting of Minnesota resident Renee Good by an Immigration and Customs Enforcement (ICE) officer has triggered a sharp and widening political confrontation in Congress, emerging as a flashpoint in the debate over President Donald Trump’s aggressive immigration enforcement strategy.

Democrats and a handful of Republicans are demanding accountability following Good’s death. Democratic leaders are pressing for a full federal investigation, limits on ICE enforcement tactics, and in some cases the defunding of ICE operations. Several lawmakers have gone further, calling for the impeachment of Homeland Security Secretary Kristi Noem, though such a move faces long odds with Republicans controlling Congress.

House Democratic Leader Hakeem Jeffries (D-N.Y.) called the incident a “complete and total disgrace,” signaling that Democrats are preparing a coordinated response. Progressive lawmakers argue that Good’s killing underscores what they see as systemic problems with ICE conduct during the administration’s mass deportation campaign, which has already been linked to several other fatal encounters.

Republicans remain divided. While most GOP lawmakers have defended the officer’s actions and the administration’s policies, some expressed unease. Sen. Lisa Murkowski (R-Alaska) said video footage of the shooting was “deeply disturbing” and called for an objective investigation and policy changes to prevent similar incidents.

The administration has pushed back forcefully. Trump and Noem have said the officer acted in self-defense, a view echoed by Vice President JD Vance, who blamed Good and described the killing as “a tragedy of her own making.” Democrats counter that the administration is misrepresenting the events and urge the public and lawmakers to review video evidence themselves.

The political stakes are heightened by timing. Congress is negotiating funding for the Department of Homeland Security ahead of a late-January deadline to avert a government shutdown. Democrats say they will use the appropriations process to impose new oversight and restrictions on ICE. Sen. Chris Murphy (D-Ct.), the top Democrat overseeing DHS funding, plans legislation to curb federal agents’ authority, including limits on where enforcement agencies can operate and requirements that officers not conceal their identities.

Good’s death has also revived memories of other fatal ICE and Border Patrol shootings in Chicago in recent months, resulting in Democratic claims that enforcement tactics have become overly aggressive. Republicans, meanwhile, largely argue that officers are being unfairly targeted and warn against tying their hands during enforcement operations.

Election impacts. As protests against ICE spread nationwide and midterm elections loom, lawmakers in both parties acknowledge that the killing has shifted the political landscape — turning immigration enforcement, already one of Washington’s most divisive issues, into a defining test of congressional oversight, executive authority, and public trust in federal law enforcement.

—Outlook for the week ahead: The week of Jan. 12 sets the tone for early 2026 legislative battles. Trade authority, sanctions policy, agricultural support and ICE funding and reform are rapidly converging — ensuring that Congress, the courts, and the White House remain tightly intertwined as the year begins.

| —KEY EVENTS |

Mon., Jan. 12

•American Farm Bureau Federation annual convention, through Tuesday, Anaheim, California. USDA Secretary Brooke Rollins speaks to the closing session in the afternoon.

• U.S./Japan relations. Center for Strategic and International Studies discussion on “Next Steps for the U.S./Japan Alliance: Deterrence, Cybersecurity, and Indo/Pacific Partnerships.”

• U.S./India relations. Center for Strategic and International Studies virtual discussion on “Strengthening the U.S./India Partnership.”

•Latin America outlook. Atlantic Council virtual discussion on “2026 in the Americas: Stories That May Drive the News,” with journalists examining the political, security, and economic issues impacting Latin America and the Caribbean.

•Iran protests. Council on Foreign Relations virtual discussion at “The Protests in Iran.”

• Democratic party strategy. National Press Club Newsmaker Program discussion with Sen. Elizabeth Warren (D-Mass.) about “her blueprint for a Democratic Party with a coalition big enough to win elections and strong enough to stand up to the rich and powerful and deliver for working people.”

Tue., Jan. 13

• Federal Reserve. St. Louis Fed President Alberto Musalem scheduled to speak.

• Donroe doctrine. Center for Strategic and International Studies virtual discussion on “The Donroe Doctrine: What Venezuela Means for China, Russia, and Iran.”

• Trade issues for 2026. Washington International Trade Association virtual discussion on “20 Trends for 2026.”

• Transportation issues. National Academies of Science, Engineering, and Medicine’s Transportation Research Board 2026 TRB Annual Meeting; runs through Thursday.

• Weather satellites. House Science, Space and Technology Environment Subcommittee hearing on “From Orbit to Operations: How Weather Satellites Support the National Security Mission.”

• Coast Guard law enforcement. House Transportation and Infrastructure Coast Guard and Maritime Transportation Subcommittee hearing on “Drugs, Thugs, and Fish: Examining Coast Guard Law Enforcement Effort.”

• Energy infrastructure. House Energy and Commerce Energy Subcommittee hearing on “Protecting America’s Energy Infrastructure in Today’s Cyber and Physical Threat Landscape.”

• Venezuela situation. George Washington University Elliott School of International Affairs virtual discussion on “Venezuela After Maduro: Power, Politics, and the Path Forward.”

• American leadership. House Ways and MeansTrade Subcommittee hearing on “Maintaining American Innovation and Technology Leadership.”

• Fraud issues. House Oversight and Government Reform Government Operations Subcommittee hearing on “Curbing Federal Fraud: Examining Innovative Tools to Detect and Prevent Fraud in Federal Programs.”

• Automotive issues. House Energy and Commerce Manufacturing, and Trade Subcommittee hearing on “Examining Legislative Options to Strengthen Motor Vehicle Safety, Ensure Consumer Choice and Affordability, and Cement U.S. Automotive Leadership.”

• Immigration issues. Brookings Institution discussion on “Assessing U.S. immigration policy in the second Trump administration.”

•Markets, economic policy. National Press Club discussion on “reporting on markets, economic policy and the forces shaping finance today,” part of its “Meet the Media” series.

Wed., Jan. 14

• Federal Reserve. Fed Governor Stephen Miran to speak on Regulations, the Supply Side, and Monetary Policy in Athens, Greece. Philadelphia Fed President Anna Paulson, Atlanta Fed President Raphael Bostic, Minneapolis Fed President Neel Kashkari, and New York Fed President John Williams scheduled to speak.

• Small business agricultural economy. Senate Small Business and Entrepreneurship Committee hearing on growing the small business agricultural economy.

•Legislative outlook including farm bill. CQ RollCall and FiscalNote virtual discussion on “2026 Federal Legislative Outlook,” focusing on issues including reauthorization of the farm bill and surface transportation programs, infrastructure project permitting and tariffs and trade agreements.

• Renewable energy. American Enterprise Institute for Public Policy Research conference on “Powering Prosperity and the New Electricity Economy,” focusing on “renewable energy’s role in meeting demand, distributed solutions that bring power closer to customers and new ways to finance the trillions in capital investment required to build the new electricity economy.”

•Mexico outlook. Inter-American Dialogue virtual discussion on “2026 Outlook —Ten Political Risks for Mexico.”

• U.S. auto industry. Senate Commerce, Science and Transportation Committee hearing on “Pedal to the Policy: The Views of the American Auto Industry on the Upcoming Surface Transportation Reauthorization.”

• CFIUS evaluation. House Financial Services National Security, Illicit Finance, and International Financial Institutions Subcommittee hearing on “Evaluating the Operations of the Committee on Foreign Investment in the United States (CFIUS).”

• Balance sheet issues. House Financial Services Task Force on Monetary Policy, Treasury Market Resilience, and Economic Prosperity Subcommittee hearing on “Striking the Right Balance Sheet.”

•Carbon capture. United States Energy Association virtual discussion on “CCUS (carbon capture, utilization, and storage) Demystified: CO2 Storage and EOR (enhanced oil recovery): Safe and Sound Underground.”

•Trump foreign policy. Carnegie Endowment for International Peace virtual discussion on “Is Trump’s Foreign Policy Out of Control?”

•Energy and climate issues. Resources for the Future event on “Big Decisions 2026,” focusing on “America’s energy and climate policy landscape.”

•EU/Mercosur: Atlantic Council virtual event on “The Future of EU/Mercosur Trade.”

• National security strategy. Reagan Foundation discussion on “the United States new national security strategy, the importance of defense spending and a strong defense industrial base, and how investing in modern capabilities supports U.S. manufacturing and American jobs.”

Thur., Jan. 15

• Federal Reserve. Fed Governor Michael Barr to speak on Stabelcoins in Washington, DC. Atlanta Fed President Raphael Bostic and Richmond Fed President Tom Barkin scheduled to speak.

• Energy issues. United States Energy Association State of the Energy Industry Forum.

•Future of finance. University of Pennsylvania’s Wharton School holds Wharton Future of Finance Forum.

•Housing affordability. Center for American Progress summit on “Home Economics: Lowering Housing Costs for All.”

• Africa risks. Brookings Institution discussion on “Key trends, risks, and opportunities for Africa’s future: Foresight Africa 2026.”

•Venezuela implications. Arab Center Washington, D.C. virtual discussion on “U.S. Raid in Venezuela: Implications for the Middle East and U.S. Foreign Policy.”

•Foreign assistance outlook. Center for a New American Security virtual discussion on “The Future of U.S. Foreign Assistance.”

•Issues affecting businesses. U.S. Chamber of Commerce 2026 State of American Business event, focusing on “the state of the economy and top issues impacting the business community.”

• Digital currency. Economic Club of Washington, D.C. discussion on “the future of digital money.”

•USDA’s national batching deadline for major conservation programs. Deadline for the first funding round of key conservation programs: Environmental Quality Incentives Program (EQIP), Conservation Stewardship Program (CSP), Agricultural Conservation Easement Program (ACEP), and Agricultural Management Assistance (AMA). It also includes the Regenerative Pilot Program, which provides targeted Farmer First assistance through EQIP and CSP.

Fri., Jan. 16

• Federal Reserve. Fed Vice Chair for Supervision Michelle Bowman to speak on Outlook for the Economy and Monetary Policy in Massachusetts, Fed Vice Chair Philip Jefferson to speak on Economic Outlook and Monetary Policy Implementation in Florida.

| —ECONOMIC REPORTS |

—Major U.S. banks take the spotlight as they gear up for their quarterly results. Investors will hear from the biggest lender, JPMorgan (JPM), on Tuesday, followed by number two lender Bank of America (BAC) on Wednesday, along with Wells Fargo (WFC) and Citi (C), and Goldman Sachs (GS) and Morgan Stanley (MS) on Thursday.

Looking at the economic calendar, traders will receive the December consumer price index report on Tuesday, followed by the delayed November producer price index report on Wednesday. The U.S. retail sales report for November is also set for Wednesday.

Finally, market participants will hear from some Federal Reserve speakers this week, including Governor Stephen Miran, Vice Chair for Supervision Michelle Bowman, and Vice Chair Philip Jefferson. The Fed’s Beige Book will be published on Wednesday.

Tue., Jan. 13

• JPMorgan Chase kicks off a week of earnings from America’s big banks. Bank of America, Citigroup and Wells Fargo report on January 14th and Goldman Sachs and Morgan Stanley on January 15th. America’s six largest banks added $600b billion to their collective stock market value in 2025, giving them a combined market capitalization of nearly $2.4 trillion.

• Delta Air Lines’ results will be closely watched to see what impact the government shutdown had on its bottom line. The shortage of federal airport staff caused mayhem to airlines’ flight schedules. Despite the disruption Delta is expecting to announce around $5bn in annual profit.

• CPI: Bureau of Labour Statistics releases inflation figures for December. November’s annual rate of 2.7% was much lower than expected, causing economists to question the BLS’s methodology of filling the gaps after it couldn’t collect data in October because of the government shutdown.

• NFIB Small Business Optimism Index

• New Home Sales

•Treasury Budget

Wed., Jan. 14

•China publishes trade data for December and for all of 2025. The country’s trade surplus in goods in the first 11 months of last year exceeded $1 trillion, already more than the 12-month total for any previous year.

• PPI-FD

•Retail Sales

• Business Inventories

• Beige Book

Thur., Jan. 15

• Empire State Manufacturing

• Philadelphia Fed Manufacturing

• Import & Export Prices

• Germany brings out its latest GDP data, including for the whole of 2025. After two years of contraction, the German economy stagnated last year, according to analysis from the European Commission, which estimates an annual growth rate of 0.2%.

Fri., Jan. 16

• Industrial Production

•Housing Market Index

•Russia’s inflation rate tumbled in the second half of 2025, from an annual rate of 9.4% in June to 6.6% in November. That gave the central bank leeway to cut its main interest rate by half a percentage point, to 16%. December’s inflation figures are published.

| —AG REPORTS |

—Ag focus is Monday with USDA’s slate of important reports. Monday’s Updates will take a look at pre-report expectations and analysis.

Mon., Jan. 12

• Export Inspections

•WASDE

• Cotton Ginnings

•Crop Production

• Crop Production – Annual

• Grain Stocks

• Rice Stocks

• Winter Wheat and Canola Seedings

•Slaughter Weekly

• Turkey Hatchery

• Cotton: World Markets and Trade

•Grains: World Markets and Trade

•Oilseeds: World Markets and Trade

• World Agricultural Production

Tue., Jan. 13

• Dairy Products

• Season-Average Price Forecasts

• Feed Grains Database

•Meat Price Spreads

•Dairy Monthly Tables

• Wheat Data

Wed., Jan. 14

•Cotton and Wool Outlook Tables

• Oil Crops Outlook

• Feed Outlook

• Wheat Outlook

• Rice Outlook

•Broiler Hatchery

Thur., Jan. 15

• Export Sales

• Slaughter Weekly

Fri., Jan. 16

• CFTC Commitments of Traders

• Livestock, Dairy, and Poultry Outlook

•Sugar and Sweeteners Outlook

•Peanut Prices

| —ENERGY REPORTS |

—Focus this week is on at least eight meetings OMB will hold with biofuel stakeholders relative to the 45Z program.

Mon., Jan. 12

• International Renewable Energy Agency’s Assembly, Abu Dhabi

• Abu Dhabi Sustainability Week; runs through Thursday

• ICE gasoil futures for January expire

• Holiday: Algeria, Venezuela, Colombia

Tue., Jan. 13

• API US inventory report

•World Future Energy Summit, Abu Dhabi; runs through Thursday

• Future Minerals Forum, Riyadh; runs through Thursday

•EIA Short-Term Energy Outlook

Wed., Jan. 14

•EIA Petroleum Status Report

• Weekly Ethanol Production

• OPEC Monthly Oil Market Report

• Carbon Forward conference, Abu Dhabi; runs through Thursday

• WTI February options expire

Thur., Jan. 15

• EIA Natural Gas Report

•BTC loading program (February)

• Holiday: Oman

Fri., Jan. 16

• ICE weekly Commitments of Tradersreport for Brent, gasoil

•Baker-Hughes Rig Count

•WTI CSOs for February expire

•Earnings: Reliance Industries

• Holiday: Indonesia